Our Corporate Governance Structure ensures that sustainability targets and ESG factors driving risk are integrated into our business.

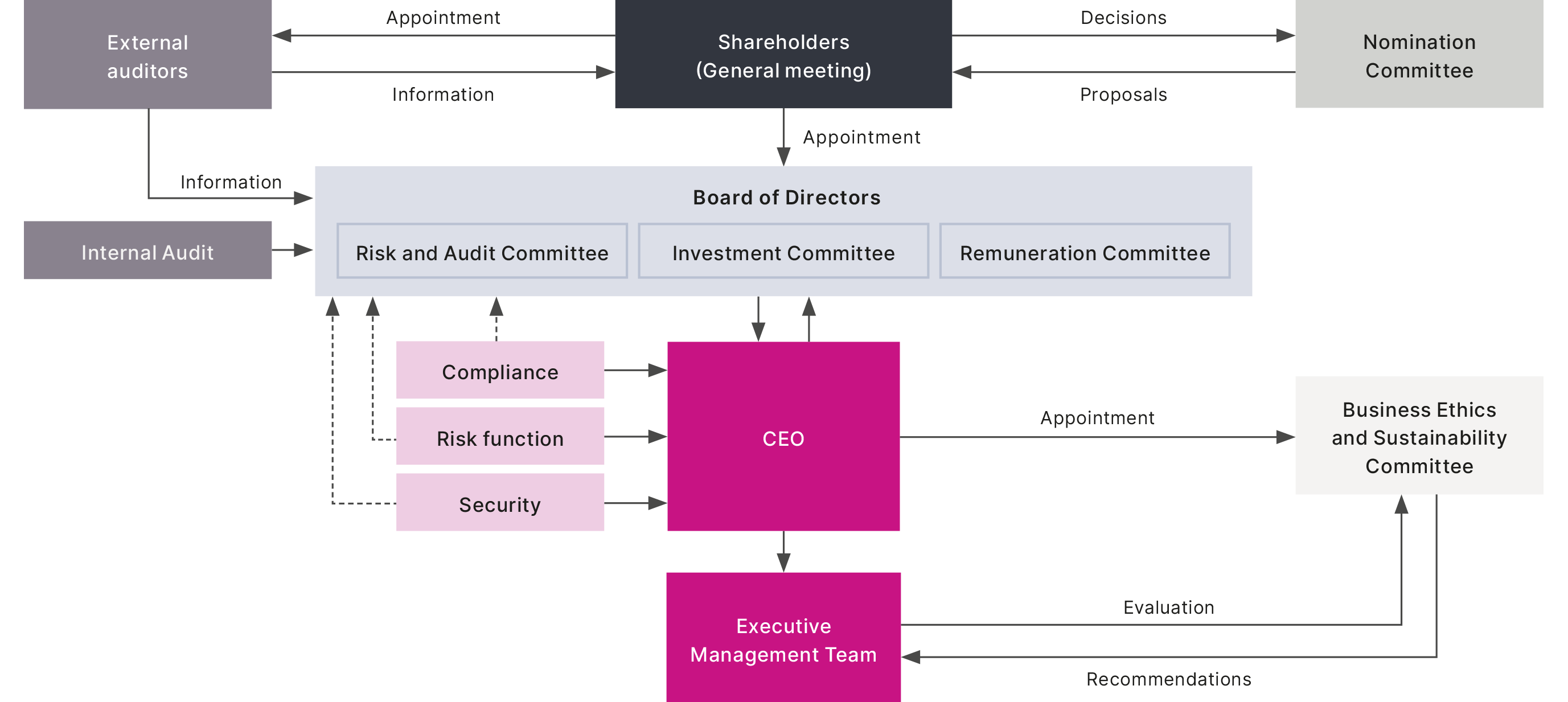

Our Corporate Governance Structure ensures that sustainability targets and ESG factors driving risk are integrated into our business and facilitates decision-making on board and management level.

For example, the sustainability strategy and targets are approved by the Board of Directors on an annual basis, ESG risks are treated within the Risk and Audit Committee (RACO) and sustainability and ESG issues are treated within the Business Ethics and Sustainability Committee (BESC) as well as through the Internal Capital Adequacy Assessment Process (ICAAP) and internal risk reports.

The model demonstrates the Corporate Governance Structure and how it interacts with our governance for sustainability issues and ESG factors, including assigned responsibilities. Read more on our Corporate governance page.

Board of Directors (BoD)The Board of Directors is the highest governing body for the sustainability strategy and decides on our sustainability work and progress annually. Its committee RACO (Risk and Audit Committee) provides advice, counsel and recommendations on key ESG matters. |

|

Chief Executive Officer (CEO)Primary responsibility for managing and executing the sustainability strategy rests with the CEO with the support from the Operational Management Team (OMT), which includes the Executive Management Team and Country Managers. |

|

Business Ethics and Sustainability Committee (BESC)A forum providing recommendations to the OMT and the organisation on matters relating to ethics, environmental, social, human rights, human resources and customer matters. Headed by the CEO and includes for example our Chief Operating Officer, Chief Investment Officer, Chief People Officer and certain other managers that the CEO nominates. |

|

Sustainability functionResponsible for developing the sustainability strategy and supporting the delivery of set KPIs in collaboration with operational and functional units. |

|

Sustainability ambassadorsElected representatives from all markets across functions, enabling the sustainability function to be better aligned with local and functional agendas |

|

Country ManagementResponsible for developing local activity plans and delivering on the strategy and KPIs. Integration and execution into daily management is secured through quarterly business review processes. |

Functional unitsResponsible for integrating and executing on set sustainability strategy and KPIs. Supporting sustainability integration into decision making processes. |

Our Code of Conduct (CoC) is governing our commitment for responsible, sustainable and ethical business conduct. The CoC includes commitments to the UN Global Compact principles and the Supplier Code of Conduct (SCoC), which governs our suppliers’ adherence to ESG issues and ethical business conduct. Our Sustainability Policy governs our sustainability and ESG efforts. The policy includes principles for each stakeholder group and demonstrates our commitment to integrate sustainability aspects in all areas of our daily business, including environmental issues, human rights, social issues, employees, and anti-corruption.

Hoist Finance’s key stakeholders are those who we create shared long-term value together with such as society, shareholders, banks and financial institutions, customers, deposit customers, and our people. With that in mind, multiple additional stakeholder groups are essential to running our business sustainably and effectively, such as suppliers and regulators. We engage frequently with all stakeholders.

SocietyAuthorities, policy makers, companies, NGOs, organisations and associations, etc. |

ShareholdersCurrent and future shareholders. |

|

Banks and financial institutionsBanks and financial institutions (our partners) who we support in freeing up resources for their core business |

CustomersIndividuals and SMEs who we support by helping them to resolve their debt and get back into the financial ecosystem. |

|

Deposit customersCustomers holding deposit accounts with us. |

Our peopleEmployees. |

|

Hoist Finance’s process for determining material topics was updated in 2022 to reflect the Global Reporting Initiative (GRI) Standards 2021, GRI 3: Material Topics requirements. The outcome of the updated materiality assessment is a list of material topics and related reporting disclosures. Hoist Finance 2022 stakeholder dialogues for defining materiality was carried out through an internal expert group and employee survey and through external qualitative interviews with stakeholders and experts, as well as a partner satisfaction survey. The interviews were conducted across stakeholder groups with for example shareholders, financial institutions, customer proxies, debt charities and employees.

See material topics below and read more on our materiality assessment in our Annual and Sustainability Report 2022.